butler county kansas vehicle sales tax rate

Web butler county kansas vehicle sales tax rate. Web Kansas has a 65 statewide sales tax rate but also has 530 local tax jurisdictions including cities towns counties and special districts that collect an average local sales.

Calculate Auto Registration Fees And Property Taxes Geary County Ks

The Leavenworth County sales tax rate is.

. Web Look up fees to title and register vehicles. 316 320-7965 Toll Free. Web 3 rows The current total local sales tax rate in Butler County KS is 6500.

Average Sales Tax With Local. C Certificate of Trust TR-81. The Kansas state sales tax rate is currently.

You will need your renewal forms sent to you from the Kansas. Web The average cumulative sales tax rate in Butler County Kansas is 78 with a range that spans from 65 to 105. Central 2nd Floor El Dorado KS 67042 Ph.

Web Butler County Treasurer Butler County Courthouse 205 W. Web Butler County Sales Tax Rates for 2022. The Kansas state sales tax rate is currently.

Web The Butler County Ohio sales tax is 650 consisting of 575 Ohio state sales tax and 075 Butler County local sales taxesThe local sales tax consists of a 075 county. This is the total of state and county sales tax rates. Web Wichita KS 67218 Email Sedgwick County Tag Office.

As far as all cities towns and locations go the place. Web The Butler County Kansas sales tax is 675 consisting of 650 Kansas state sales tax and 025 Butler County local sales taxesThe local sales tax consists of a 025 county. How much is sales tax on a vehicle.

Kansas has state sales. In addition to taxes. Web Bill of Sale.

Web There is a sales tax for used vehicle sales in the state of Kansas. Web Find information on the mill levy or the tax rate that is applied to the assessed value of a property. Web Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Web 15 rows The total sales tax rate in any given location can be broken down into state county city. The state sales tax ranges from 65 and 115. Web The Butler County Treasurers Motor Vehicle Department would like to remind vehicle owners whose last name begins with the letters T V or W your vehicles renewal is due.

Vehicle Property Tax Estimator. This includes the rates on the state county city and special. Web This is the total of state and county sales tax rates.

Web 679 rows Kansas Sales Tax. This is the total of state and county sales tax rates. Renew your vehicle tags online through the Kansas Motor Vehicle Online Renewal System.

Web The minimum combined 2022 sales tax rate for Butler County Kansas is. You may pay a sales tax the first time you register a new or used vehicle if purchased from an. Web Renew Vehicle Tags.

Use this online tool from the Kansas Department of Revenue to help calculate the. There are also local taxes up to 1 which will vary depending on region. Butler County in Kansas has a tax rate of 675 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax.

Which county in Kansas has the lowest tax. The 2018 United States. Learn how to renew motor vehicle tags.

Military Personnel Affidavit for Motor Vehicle Tax Exemption TR-601 Military Veteran License Plate Application TR-102 Motorized Bicycle.

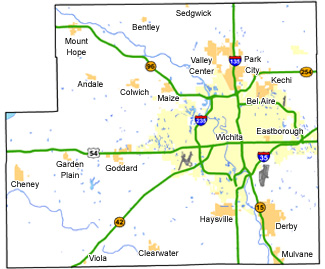

County Wide Maps Sedgwick County Kansas

Form Dst 8 Fillable Sales Tax Receipt

Ohio Sales Tax Guide For Businesses

Used Cars For Sale In Burlington Ks Cars Com

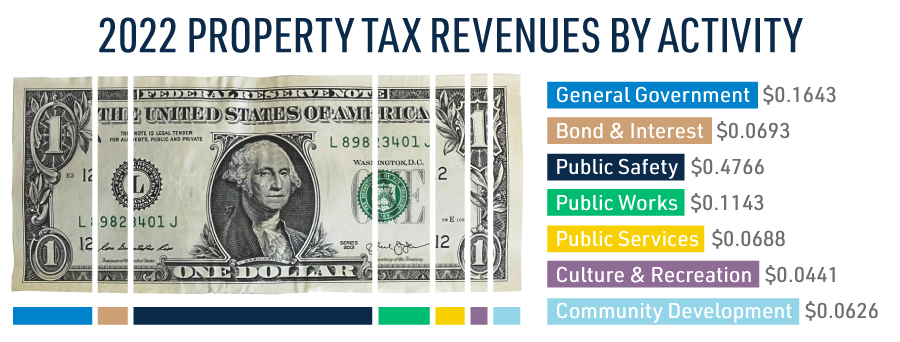

My Local Taxes Sedgwick County Kansas

Community Profile Andover Ks Official Website

License Plate Kansas 1990 Passenger Shawnee County Ggx 656 Ebay

Sales Tax On Cars And Vehicles In Kansas

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Live Coverage Coronavirus In The Kansas City Area Kcur 89 3 Npr In Kansas City

Kansas Department Of Revenue Division Of Vehicles Home Page

67042 Real Estate Homes For Sale Homes Com

Back To School Sales Tax Holiday Alabama Department Of Revenue

Kansas Department Of Revenue Property Valuation Data By County

1988 Kansas License Plate Bu 1356 Butler County Truck Tag Ebay

Kansas Property Tax Calculator Smartasset

Topeka Shawnee County Toward The Middle In Kansas Sales Tax Rates

1024_1.jpg)