pay utah withholding tax online

You may use this Web site and our voice response system 18005553453 interchangeably to make payments. Register with the Utah Department of Workforce Services 866-435-7414.

You may also pay with an electronic funds transfer by ACH credit.

. Workers Compensation Coverage administered by the Utah Labor Commission. Taxpayer Access Point TAP Help Manual. Multiply line 4 by 3 03 6.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. You can pay your Utah taxes in person by check money order cash or credit card at a Utah State Tax Commission office. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

Employment Taxes and Fees. Please contact us at 801-297-2200 or taxmasterutah. Do you need to apply for a tax account.

You may also need. It does not contain all tax laws or rules. If less than zero enter 0.

You have been successfully. Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0266. This website is provided for general guidance only.

Credit for sales tax paid to another state on use tax purchases 8. Utah use tax subtract line 7 from line 6. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

File electronically using Taxpayer Access Point at taputahgov. Utah Taxpayer Access Point TAP TAP. If you pay Utah wages to Utah employees you must have a Withholding Tax license.

For security reasons TAP and other e-services are not available in most countries outside the United States. Most taxes can be paid electronically. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers.

Online payments may include a service fee. Log into the Employee Self Serve ESS System and look for the Personal Information section select the W-4 Tax Withholding option. All state income tax dollars support education children and individuals with disabilities.

It does not contain all tax laws or rules. The first eleven characters are numeric and the last three are WTH Do not enter hyphens. Attend a Live Workshop.

Utah Withholding Taxes Website. Follow the instructions at taputahgov. You may pay your tax online with your credit card or with an electronic check ACH debit.

Multiply line 1 by line 2 4. You will be charged a convenience fee for credit card payments. 11 Payment - single employer filing.

Add line 3 and line 5 7. Unemployment Insurance administered by the Utah Department of Workforce Services. Amount of grocery food purchases subject to use tax 5.

For security reasons TAP and other e-services are not available in most countries outside the United States. Use tax rate decimal from Use Tax Rate Chart X. Dont forget to increase the rate for any overtime hours.

Pub 2 Utah Taxpayer Bill of Rights contains additional information regarding taxpayer rights and responsibilities. Please contact us at 801-297-2200 or taxmasterutahgov for more information. See Taxpayer Access Point TAP for electronic payment options including setting up a payment agreement.

Please note that for security reasons Taxpayer Access Point is not available in most countries outside the. Return to Tax Listing. For all your salaried employees divide each employees annual salary by the number of pay periods you have.

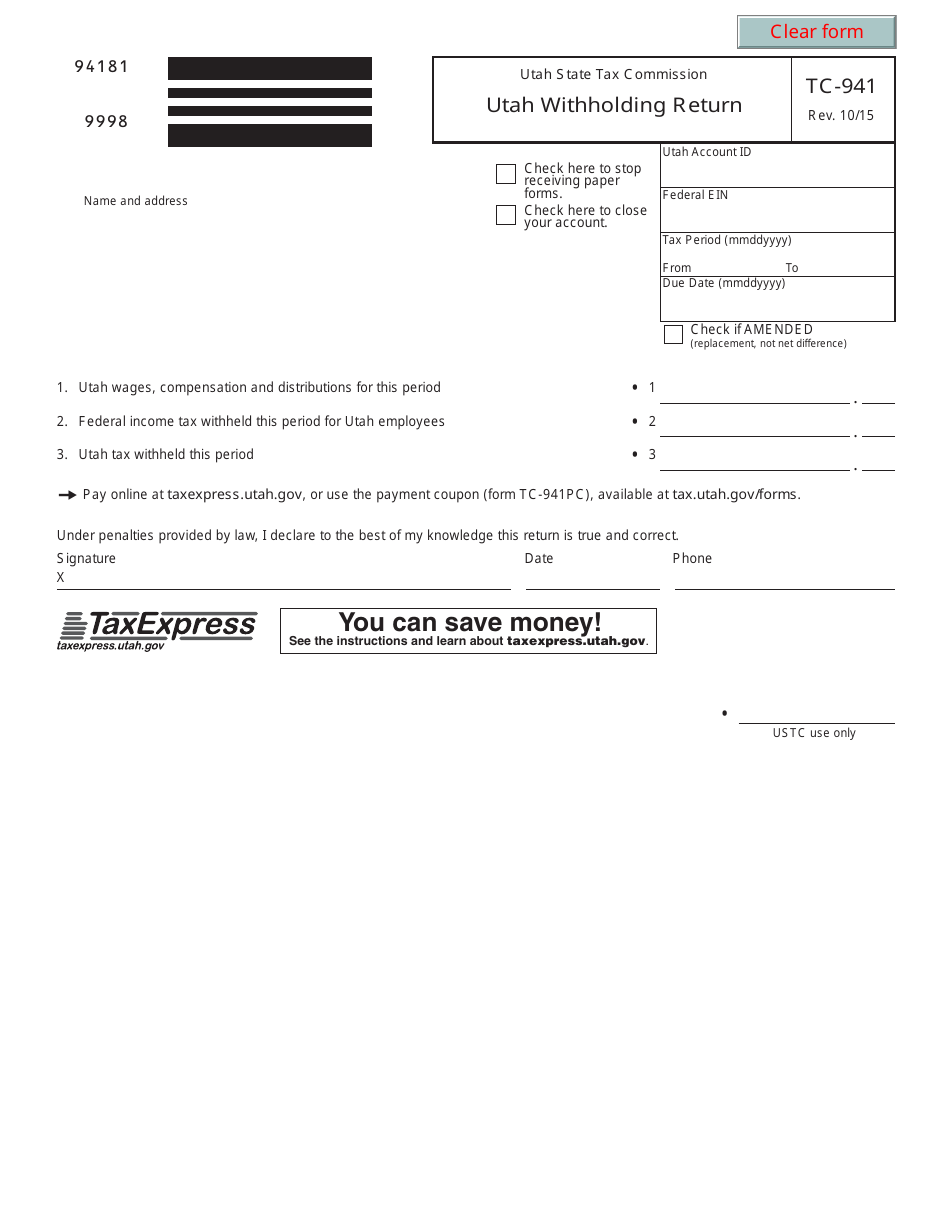

Also add in commissions tips or bonuses into gross wages. Mail your payment coupon and Utah return to. You must send a completed payment coupon form TC-941PC if you mail your payment.

Scroll to the Utah Tax Setup headline and select Manage taxes. Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search Utahgov opens in new window Skip to Main Content. Line 2 Enter the employerpayer Utah withholding account number W-2 box 15 or 1099.

In Utah there are three possible payment schedules for withholding taxes. If filing a paper return allow at least 90 days for your return to be processed. Line 1 Enter the employerpayer federal EIN W-2 box b or 1099.

You must include your FEIN and withholding account ID number on each return. For all your hourly employees multiply their hours worked by the pay rate. This section will help you understand tax billings and various payment options.

ECheck or Credit Card Pay through your online Taxpayer Access Point TAP account at taputahgov. Rememberyou can file early then pay any amount you owe by this years due date. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

Change or Display to update your current amount select Change and and you are able to change your filing status as well as the number. You will then see a table that displays your current selection below the table you should see two options. You can also pay online and avoid the hassles of mailing in a check.

Publication 14 Utah Withholding Tax Guide. You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. The Utah withholding account number is a 14-character number.

You can also pay online and avoid the hassles of mailing in a check. If you are required to make deposits electronically but do not wish to use the EFTPS tax payment service yourself ask your financial institution about ACH Credit or same-day wire payments or consult a tax professional or payroll provider about making payments for you.

Form Tc 941 Download Fillable Pdf Or Fill Online Utah Withholding Return Utah Templateroller

Handling Multi State Returns In Proconnect Tax Online Tax Pro Center Intuit

Utah State Tax Commission Official Website

Utah Sales Tax Small Business Guide Truic

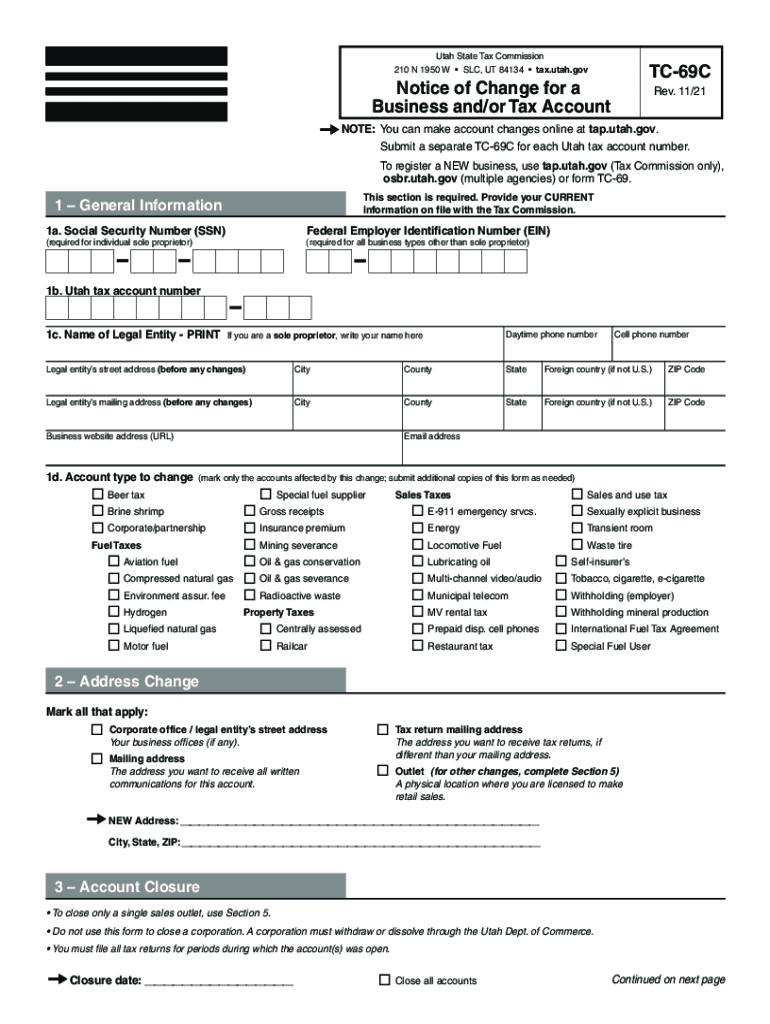

Ut Tc 69c 2021 2022 Fill Out Tax Template Online Us Legal Forms

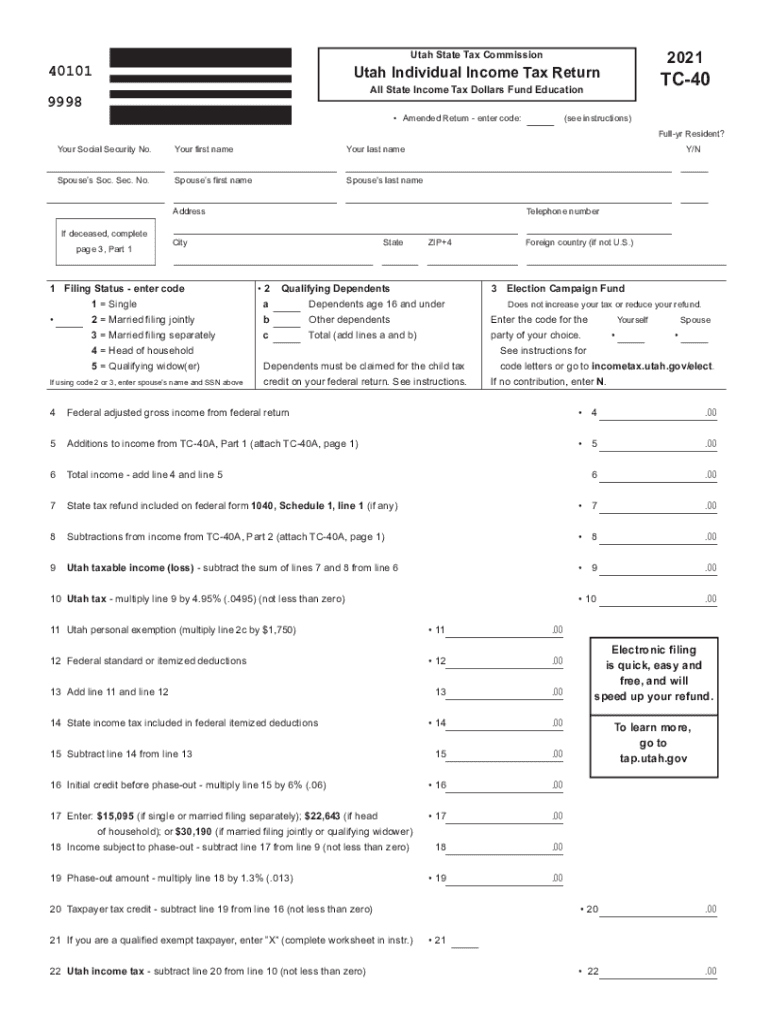

Ut Tc 40 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

Electronic Payroll Taxes For California Florida And Texas

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Handling Multi State Returns In Proconnect Tax Online Tax Pro Center Intuit

Utah State Tax Commission Official Website